One of the hottest new trends in the crypto and blockchain ecosystem is the NFT. The new digital asset has seemingly exploded out of thin air and is taking the world by storm. Some believe the trend is a bubble that will implode in due time. Yet diehard fans are convinced it is here to stay.

Regardless of your stance on the debate, one thing is for sure – the NFT market has already grown exponentially. According to Dapp Radar, sales volume in the NFT sector shot up from $13.7 million during the first half of 2020 to $2.5 billion in the first half of 2021. In the first quarter of 2021, sales reportedly surged by 2,100% year-over-year (YoY) according to NonFungible.com.

For a bit of context, NonFungible estimates that the market was worth $250 million in 2020. That came following a 299% increase in transaction value compared to the previous year.

According to CryptoArt, the total digital art sales in this sector at the beginning of June 2021 is at least 200,000 units. Their cumulative value was a remarkable $600 million.

In case you are wondering what we are going on and on about, read on. Our comprehensive guide seeks to uncover everything there is to know about the NFT asset class. It will cover what these NFTs are, what they do and how you can benefit from them. Let’s get started.

You probably heard about the digital-only artwork that sold for a whopping $69.3 million at Christie’s. Aside from the mind-boggling price, it may have been surprising to learn that the winning bidder did not receive any physical item. Rather, he got a digital token known as an NFT.

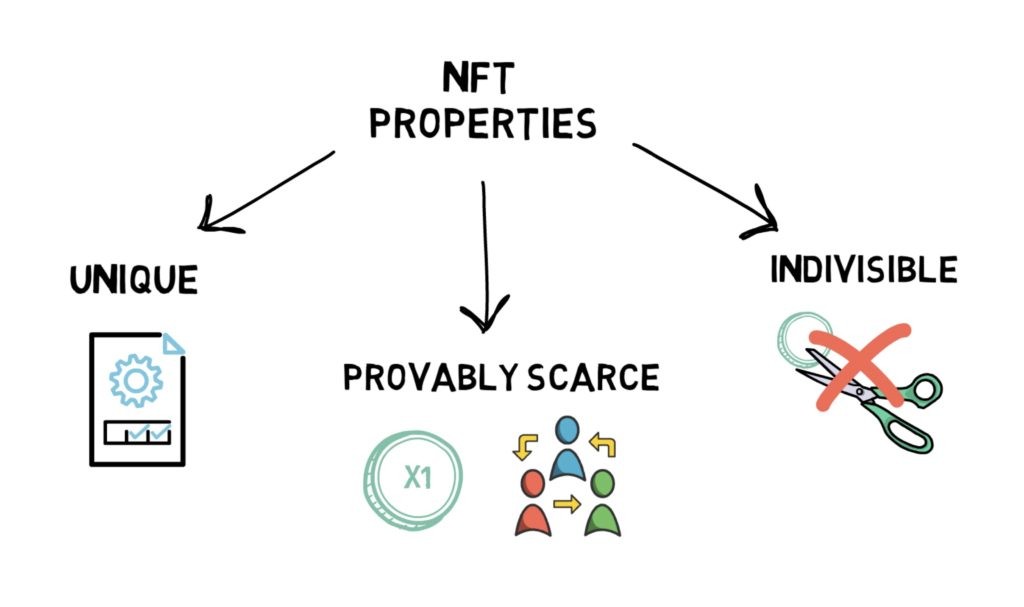

An NFT is an abbreviation for non-fungible token. It refers to a digital asset that represents ownership of something unique. The asset class makes it possible to tokenize certain items. Tokenized items can only have a single owner at a time, with blockchain technology ensuring their security.

In essence, a non-fungible item is one that is not interchangeable because of its unique features. On the other hand, fungible items can be exchanged because what defines them is their value, and not any unique properties. A good example of a fungible asset is money – it is possible to swap $10 with ten $1 bills because they share the same value.

As such, one can only tokenize a unique, one-of-a-kind, non-interchangeable item. Good examples of these include (but are not limited to) artworks and collectibles. Though it is possible to take a photo of the item or print it out, there will only ever be a single original.

Another unique aspect of this new asset class is that items exist only in the digital world. While it is possible to buy and sell them, this happens virtually as there is no tangible product. When one buys an NFT, they get a verifiable token proving asset ownership on the blockchain. Therefore, owning such a digital token is comparable to having a certificate of authenticity.

What makes traditional art pieces valuable is the fact that they are one-of-a-kind. However, digital assets are easy to duplicate. To deal with this, tokenization creates proof of ownership based on blockchain technology. The technology does not stop people from copying or distributing a digital item. However, possessing the token proves that the buyer is the rightful owner of the original, creating exclusivity.

The blockchain ledger on which a token is created holds a record of all items and their respective owners. Apart from preventing forgery, blockchain technology offers yet another benefit. Through the use of smart contracts, the creator of an artwork, for instance, can get a cut of future token sales.

Most non-fungible tokens run on the Ethereum blockchain. The blockchain creates a permanent digital record, an irrefutable ledger of every transaction on the network.

A creator retains the copyright for the tokenized item. They have the right to duplicate it and can thus create copies of the original. However, as is the case with physical collectibles, the original holds the highest value. While the buyer can also make duplicates of the original, they require the creator’s permission to do so.

But what determines their worth? Well, just like collectibles, these belong to a category known as psychological assets. Simply put, their value boils down to the amount a person is willing to pay in exchange for ownership.

In themselves, the tokens hold no intrinsic value. Rather, they assign value to underlying items. Consequently, the value of the asset that the token validates can fluctuate based on consumer tastes and other factors. For this reason, there is no ceiling for their value.

Illustrating the popularity of this new phenomenon, big brands like Louis Vuitton, Nike, Formula 1 and NBA are taking notice and participating. Over the past few months, NBA Top Shot has sold tokenized assets worth more than $500 million.

Rather than being tools for pure speculation, they are playing a much bigger role in the grand scheme of things. Through entertainment and recreation, they are tapping into the mainstream. And they are helping the masses get a glimpse of the value behind decentralization and blockchain.

Though NFTs have hit the limelight fairly recently, the concept dates as far back as 2012. In December that year, the Colored Coins project offered the earliest iteration of the concept. Though the idea was a lot less sophisticated, it entailed using blockchain technology for transacting in assets like digital collectibles and company shares. Among the persons behind this project was Ethereum co-founder Vitalik Buterin. Unfortunately though, limitations of the Bitcoin protocol hampered the project’s progress.

In 2014, the launch of Counterparty, still on the Bitcoin blockchain, introduced card/meme trading. The Spells of Genesis game in 2015 was thefirst to issue blockchain-based in-game assets on the Counterparty platform. October 2017 saw the launch of CryptoPunks, the world’s first marketplace showcasing rare digital art.

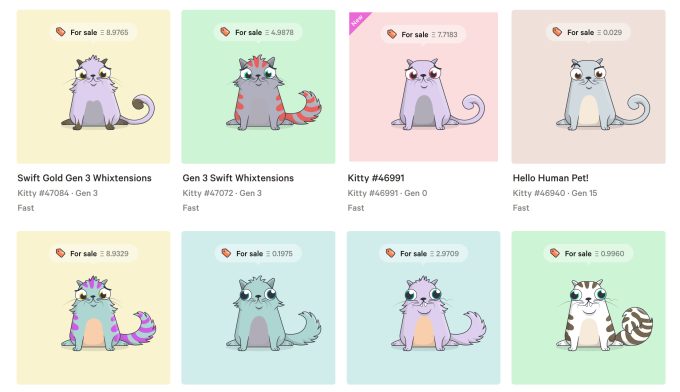

It was, however, the launch of CryptoKitties in 2017 that marked the watershed moment for the NFT market. The project went viral, raising $12.5 million in investment. At its peak, the project had collectibles worth 5,000 ETH and accounted for 10% of traffic on the network. Renowned NFT marketplaces like OpenSea and RareBits launched during this period to support the new concept.

Fast forward to 2021 and literally everything that can be tokenized has been tokenized. Though CryptoKitties is close to four years old, it has yet to slow down. Enthusiasts have bred more than 50,000 generations of kitties. And over $30,000 worth of transactions still take place on the network every single day.

But how does the overall NFT market work and how can you be a part of it? Let’s find out.

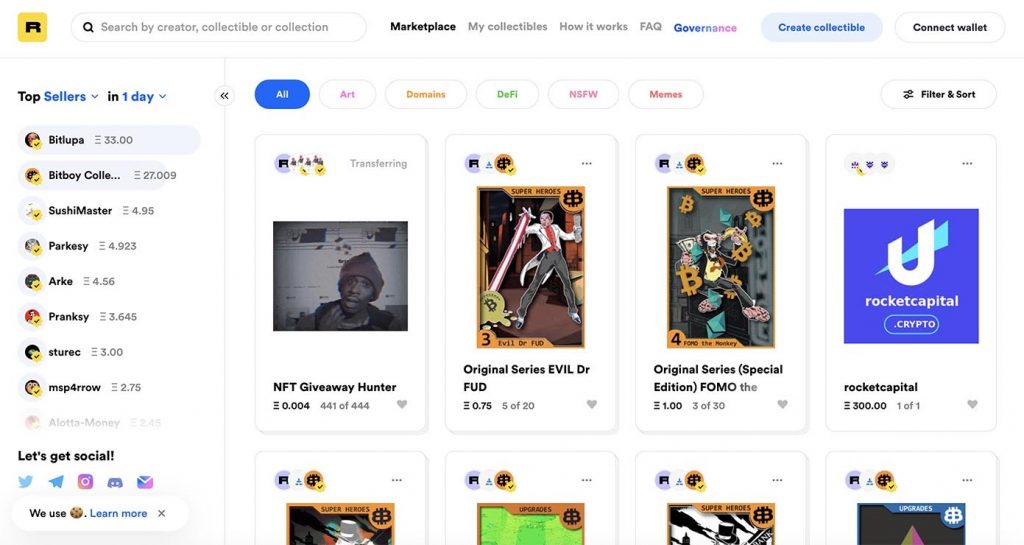

As is generally the case with everything blockchain-related, it is assumed that there is a steep learning curve to trade NFTs. But that is not the case. If you are thinking of joining the bandwagon, all you need to do is find a suitable marketplace and get started.

For persons interested in buying or selling these digital assets, there are a number of popular marketplaces where transactions take place.

They include:

To make your first purchase, here are the steps to follow:

Step 1: Create and Fund Your Account

Depending on the marketplace you choose, you can use various currencies to fund your purchase. While some strictly use cryptocurrencies, others are more versatile allowing the use of credit cards.

Find out which currency your platform of choice supports and fund your account or blockchain wallet. Connect your wallet to the marketplace account and you can start making purchases.

Step 2: Choose an NFT

Browse through the offerings on the marketplace and identify the item you wish to buy. Think of the platform as a gallery where you get to browse through items on display and make a pick.

Step 3: Buy

These marketplaces often work like auction houses. Once you identify the asset you want to buy, you will need to offer a bid and hope for a win. However, you may also find listings with an option to “Buy Now” at a fixed price. Click “Buy Now” then select “Checkout” and submit the order to make your purchase.

To sell an NFT, here is what you need to do:

Step 1: Create a Digital Item

Before starting the process, decide which blockchain you will use to issue your tokens. Though Ethereum is the top choice for most issuers, there are a good number of other options. These include:

This is a crucial step because your choice of blockchain determines where you can or cannot sell the asset. Every blockchain uses a distinct protocol and different marketplaces support specific protocols. For instance, you cannot sell an asset created on Ethereum on VIV3 as it is based on Flow. OpenSea, on the other hand, supports Ethereum-based tokens.

Step 2: Create Your NFT

Once you have identified the protocol to use, select a suitable NFT-centric platform on which you can upload your digital file. If you choose Ethereum, supporting platforms include Rarible and Mintable among others. Some sites like Makersplace require you to register beforehand and get listed as an artist.

Click “Create” and then select the relevant file from your computing device to upload. Set a selling price for the item or select “Put on Sale” to auction it off. Name the asset and enter a description for it. If you want a cut of every resale, set your royalties.

Step 3: Connect Your Wallet

After completing the setup process, it is time to connect your wallet and pay the applicable gas fee. The fee is required to process the listing.

Step 4: Sign Sell Order

The final step is to get the listing active by signing the sell order. Click “Start” and once a blockchain wallet popup appears, select “Sign” and you are good to go.

When the listed item sells, the funds will automatically transfer to your blockchain wallet.

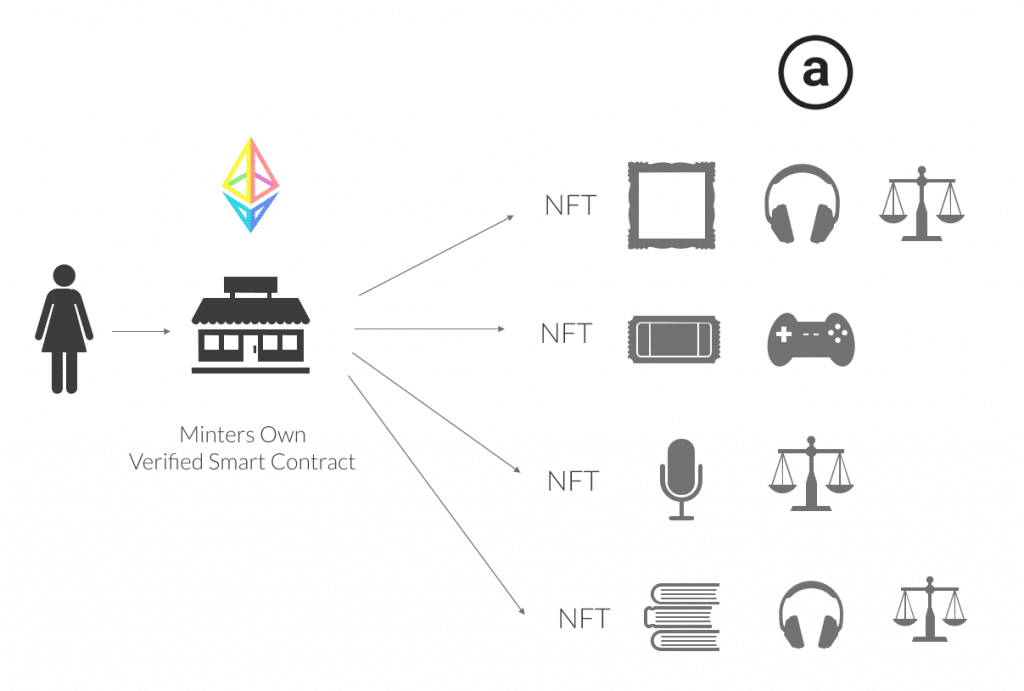

People create or “mint” NFTs from digital objects representing both tangible and intangible assets. These include:

With museums and galleries having to close during the pandemic, hordes of artists turned to this asset class. The concept has streamlined artists’ revenue as it has connected them directly to consumers.

The technology has become popular for creating tokenized versions of celebrities and star athletes for fans to collect. Traditional collector items such as stamps, coins and trading cards also feature prominently.

In much the same way that you can tokenize a video or image file, it is also possible to do the same with audio files. Independent artists are able to stream their music and even sell royalties using this solution. The concept solves a big issue for musicians – getting their fair share of royalties.

Using virtual reality platforms, users create parcels of virtual land which they can then monetize.

Gamers make an ideal target market thanks to their familiarity with the concept of virtual currencies and worlds. We will go into greater detail on this further ahead in the article.

While these are the main categories experiencing massive growth, others such as fashion and sports are also on the rise.

There are plenty of use cases for this concept that apply right across the board in a vast range of sectors.

Among the biggest areas of application for the technology is the digital content realm. The current industry framework is broken. As a result, content creators often lose their profits to platforms that severely limit their earning potential. To illustrate, consider artists who publish their work on social platforms. While they get exposure, they may make little to nothing from this. However, the social network in question will sell ads to the artist’s followers and make a lot more from that.

Thanks to tokenization, content creators no longer have to hand over ownership of their pieces to the networks they use to publicize. Rather, ownership is intrinsically baked into their work. Funds from all sales go directly to them and they automatically receive royalties from resale.

While it is possible to copy/paste an art piece, it is comparable to getting an image of a highly prized Picasso on the internet. The verifiably real item will always hold tons more value than a copy.

Investors are constantly expanding their portfolios and one area of interest for some is digital finance. For investors familiar with collectibles such as classic cars, fine wine, artwork and trading cars, this could provide high allure. Collectibles make viable investments because over time, they appreciate in value. Furthermore, their valuations hardly correlate with other investment markets. Appreciating value is normally based on two aspects, scarcity and the creator.

Investors in digital collectibles consider the same factors. And unlike traditional investors, they have one distinct advantage – guaranteed authenticity. That combination of factors has made these virtual assets attractive for buyers as well as sellers.

The two worlds of NFTs and DeFi have begun coming together in interesting ways. Collateralization of loans is one such application. When DeFi users borrow money, they have to guarantee that the lender will get their funds back. Failure to pay back the loan means the collateral will be sent to the lender.

In many cases, crypto is considered acceptable collateral, but one may not always have enough of it. Tokenized assets come in handy in such cases allowing access to loan under similar terms.

Groundbreaking sales such as that of the aforementioned artwork by Beeple may have popularized the sector. But such purchases are often beyond the reach of the majority. Consequently, the idea of fractionalization has gathered steam in the space. As the word suggests, it involves virtually breaking apart an asset. Enthusiasts can thus own just a portion of a prized collectible. By pooling funds in this manner, investors are able to profit from high-value pieces.

As mentioned above, gaming and NFTs seem to be a perfect match. Not surprisingly therefore, the asset class has been booming in the gaming market. Tokenization within the space facilitates seamless transfers and exchanges for in-game items.

That stands in stark contrast with traditional gaming. Traditional games in many cases prohibit transfer or sales of in-game assets. Until fairly recently, gaming was predominantly centralized. All the data, assets and currency related to a particular game only operated within the confines of that game. Essentially, players do not own any of these items. Consequently, the moment they stop playing, their collectibles are lost forever.

In a fairly recent incident involving the MMORPG Rust, a fire in France destroyed about 30 servers connected to the game. Because there was no offsite backup, thousands of players lost all of their data, including in-game assets.

Seeking to address such weaknesses in the current model, a number of old-school names are making their foray into blockchain. In gaming, the technology gets a major boon from tokenization as digital assets represent in-game items.

Skins are a popular part of video games and they typically include outfits, weapons and visual enhancements for personalizing avatars. Gamers often pay a premium to get them, and the more the customization options, the higher the player engagement. The fact that gamers spend thousands of dollars on these items, which have no functional role whatsoever, is simply stunning. Imagine what would happen if they could get more use out of these accessories.

Blockchain technology is gradually upending the status quo, one game at a time. Consider some benefits that come from a merger of the two worlds:

In cases where a game shuts down or player data gets lost or compromised, the technology makes asset recovery possible. This is because digital tokens exist, not on proprietary systems, but on independent blockchains. Regardless of what happens to gamers’ data or the game itself, assets remain secure and accessible.

Decentralization of games makes it possible to support the use of in-game assets across different games. Items that players win or purchase in one game are now transferrable to other games. That places a real-world value on these items.

Tokenized assets allow players rather than developers to own in-game assets. As such, the gaming experience becomes more rewarding and tangible. Moreover, gamers have the authority to sell assets, move them into other compatible games or save them.

The structure of traditional gaming primarily benefits developers due to the one directional flow of value. Players spend money to unlock new assets but they are not able to capture value and utility. With the adoption of this technology, gaming becomes a vibrant ecosystem with opportunities for investment, giving rise to a new economy. Allowing players to monetize their time is likely to make gaming more appealing than it already is.

For collectors, rarity and authenticity translate to value and gaming NFTs offer both. Thanks to the immutable records on an underpinning blockchain, it is possible to prove the scarcity of in-game assets. Additionally, the ledger authenticates the ownership of each item and validates the number.

Point of Caution

It is worth noting that these new avenues of incentivization could be prone to major challenges. Foremost among these is striking the delicate balance between money-making and engaging gameplay. If players go into gaming to extract as much value as they can while contributing as little as they can get away with, the concept would not be sustainable.

A game offering asset tokenization would need to appeal to gamers based on its own merit – offering a great design and flawless mechanics. Being able to add a play-and-earn model to entertaining gameplay should make it outstanding.

In line with the impressive growth seen in the use of NFTs in gaming, a major industry player has launched a unit focused on precisely that. Ethereum-scaling project Polygon recently introduced a unit aimed at growing the use of blockchain in gaming. The unit, Polygon Studios, aims to bridge the gap between Web 2 and Web 3 gaming.

Polygon already boasts gamers numbering more than 100,000 and at least 500 decentralized applications. These include gaming projects such as Decentraland, Skyweaver and Aavegotichi as well as the marketplace OpenSea.

Previously known as the MATIC network, Polygon is an interchain solution designed to address scalability issues on the Ethereum blockchain. It was introduced in October 2017 as a testnet and was later turned to the mainnet. Its core concept is the creation of an infrastructure supporting blockchain networks that have the capacity to interface with each other. It aims to combine Ethereum’s security, interoperability and liquidity with scalability and adaptability. As a result of its remarkable growth, it has attracted investments from top investors like billionaire Mark Cuban.

Part of the reason for the scaling project’s popularity is its appeal to developers who want to avoid high transaction fees on Ethereum. It therefore operates as a layer on the mainnet offering faster processing and higher efficiency. For NFT users, it eliminates gas fees from transactions. Marketplaces running on its protocol thus facilitate buying and selling of tokenized items without the outrageous fees associated with Ethereum. At the peak of the NFT mania earlier this year, gas fees would add up to $300 per Ethereum transaction. Polygon has brought the figure down to almost zero.

The idea behind its new unit is to assist developers in the creation of blockchain-based games. To this end, it has set up a fund valued at $100 million for projects seeking to merge the two worlds. It also has as its objective assisting the development of NFT marketplaces and models. As of July 2021, over 60% of web 3.0 games have opted to use Polygon. These include Somnium Space, Sandbox and Decentral Games among others.

With the new unit in place, Polygon will offer developers plug-and-play software development kits (SDKs). These will enable them to introduce blockchain features into non-blockchain games. Its NFT-based gaming model seeks to address monetization challenges that game developers currently face.

On free-to-play games for example, conversion rates remain remarkably low. And for season pass models, there is a challenge with pricing, as it does not allow for customization based on usage. Developers are also missing out on transactions that take place in black markets such as character boosts and gold-buying.

At present, more than 80% of digital gaming revenue comes from FTP models. However, only a meager 2.2% of FTP players actually spend on games. Considering that the model currently generates $87 billion a year, capitalizing on the lost revenue offers a huge potential. According to Polygon, ownership of in-game assets could expand the market by more than $50 billion per 1% of players who convert. Blockchain increases the chances of gamer conversion and lowers the risks involved with in-game spending.

Pros

Cons

The emergence of non-fungible tokens has revolutionized multiple markets, allowing creators to get direct access to customers. Intermediaries have always taken a huge chunk of profits from creators. Moreover, in a bid to get exposure, some make little to nothing from their works while social networks make great gains.

Additionally, the technology makes it easy to prove ownership and authenticate items thanks to blockchain technology. Participants in the market also get to generate a steady stream of income from sales as well as royalties. And for gamers, it is possible to own, trade and monetize in-game assets, a feat that is not possible in the traditional space.

On the downside, however, some shy away from the opportunity fearing a high entry barrier. Blockchain technology is still in its nascent stages and involves a relatively steep learning curve. There is also the constant fear that speculation will drive the market into a manic stage. In turn, this will result in an implosion which may cost investors a fortune.

Another industry that the NFT craze is slowly disrupting is that of gambling. The industry has often been accused of being stuck in the past. Admittedly, not much innovation has taken place in it during the recent past. This is particularly so with regard to gameplay and the manner in which they interact with players.

Just like in the gaming industry, tokenization in gambling could introduce the option of element ownership. On one of the few NFT gambling sites in operation, players get to own and breed digital racehorses. At its core, the idea simply seeks to mix things up and comes with all the benefits considered above relating to asset digitalization.

Using digital tokens could also address fairness issues in the gambling sector. For instance, by attaching them to winnings, bitcoin casinos could have an effective means to verify earnings and ownership.

No. The two are similar in the sense that their records are stored digitally on a blockchain. However, a non-fungible token is a unique, verifiable digital asset representing a real-world item. It differs from a cryptocurrency in the sense that two NFTs are interchangeable, while cryptocurrencies are interchangeable.

People own these tokenized assets because of their perceived value. Just like collectibles such as fine wine and art pieces, their scarcity and uniqueness can make them valuable. Buying one and reselling it at a higher value will result in a financial benefit.

Ownership of tokenized assets is recorded on the underpinning blockchain. Finding the relevant entry on a blockchain ledger is similar to locating a certificate of authentication.

No. The asset class has been in existence since 2012. However, it only recently gained popularity with the launch of CryptoKitties in 2017.

To find out how we use cookies, please read our cookie policy or click accept to continue.

Sign up for exclusive bonuses from Thecryptostrip